Farming the Sun: 5 Questions to Ask Before Signing a Long-Term Solar Lease

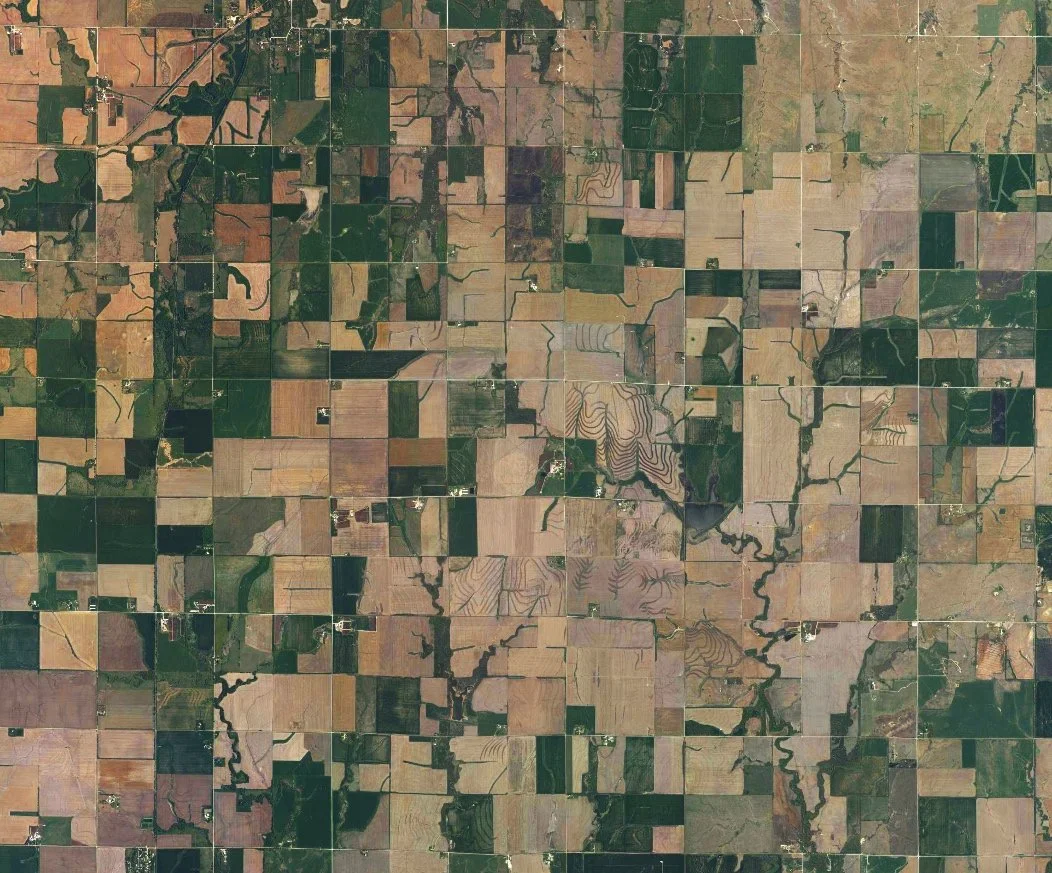

/As one farmer recently told me, “If we can’t make money grain farming, we might as well farm the sun.” Clean energy is hot on the farm, and its more than anaerobic digesters and windmills. Many farmers are being approached by solar energy developers who ask them to sign up acres of farmland for conversion into solar farms. These farmers are presented with very long-term leases that take farm ground out of production for decades. These sort of contracts require careful consideration. Here are some preliminary questions to ask the developer, but if you are considering a long-term solar lease, please contact your attorney too.

Is the developer paying you enough to close the door on competitors? The solar lease (sometimes called a solar easement) will likely seek to tie-up the property for a period of years while the developer arranges permits, funding, zoning, and other items necessary for construction. The developer will want to pay as little compensation as possible during this exploratory period, since that is the developer’s period of greatest risk. Provided the farmer can continue farming the land, little rent during this period is probably okay. But consider, too, that the farmland will be taken off the solar leasing market during this period. Make sure the the payoff isn’t only realized years down the road, because that may be a vieled attempt to prevent the farmer from signing a deal with a competitor.

Do the lease payments take inflation into account? A 30, 40, or 50 year lease should have a built-in rent payment escalator. This could be based upon the consumer price index (CPI), a regularly posted inflation rate, or a negotiated percentage annual increase in payments. What seems like a lot of money today may not be in 50 years.

Who gets the carbon and tax credits? I can already tell you the answer to this one, the solar company will take the credits. The carbon marketplace is constantly changing, so giving up these future, unknown credits today may seem like a wise decision. Understand you may be giving up an enormous upside if these markets take off years from now and companies are willing to pay farmers to sequester carbon as part of their farming activities.

Is the developer committed to keeping the solar farm maintained to your standards? A field of solar panels seems harmless enough, but what happens if the solar field is full of noxious weeds that spread onto neighboring fields? It could be an enormous burden on the farmer to maintain the land around the solar field. Make sure the standards are in place to address the your expectations for how the solar field will look and be maintained. The developer will likely not be the long-term power generator. Your conditions need to run with the land and attach to any future users.

Will the developer provide a removal bond? If the something goes wrong years from now and the solar company operating the solar farm goes bankrupt, the farmer should not be left with a field full of salvage-value solar panels and no contracts to sell power. Returning the land to a condition suitable for growing crops will be prohibitively expensive. A farmer should insist that the developer provide some form of security that will pay for the cost of removal if the solar company goes bankrupt or disappears. This is a must.

These are not the only questions to ask a developer. They are a guide to start the discussion. Never be pressured to make a quick decision. Haste is the seller’s best friend. Take your time to review the proposal, discuss with the next generation, and interview references. A solar lease can be a great opportunity, but do it right. And of course, take time to discuss with your attorney.