Law Clerk Blog Post: Soy Market Plummets with Continued Battle of Trade Tariffs

/Our summer law clerk, Nick Whitten, writes this guest blog post about the effects of tariffs on soy markets.

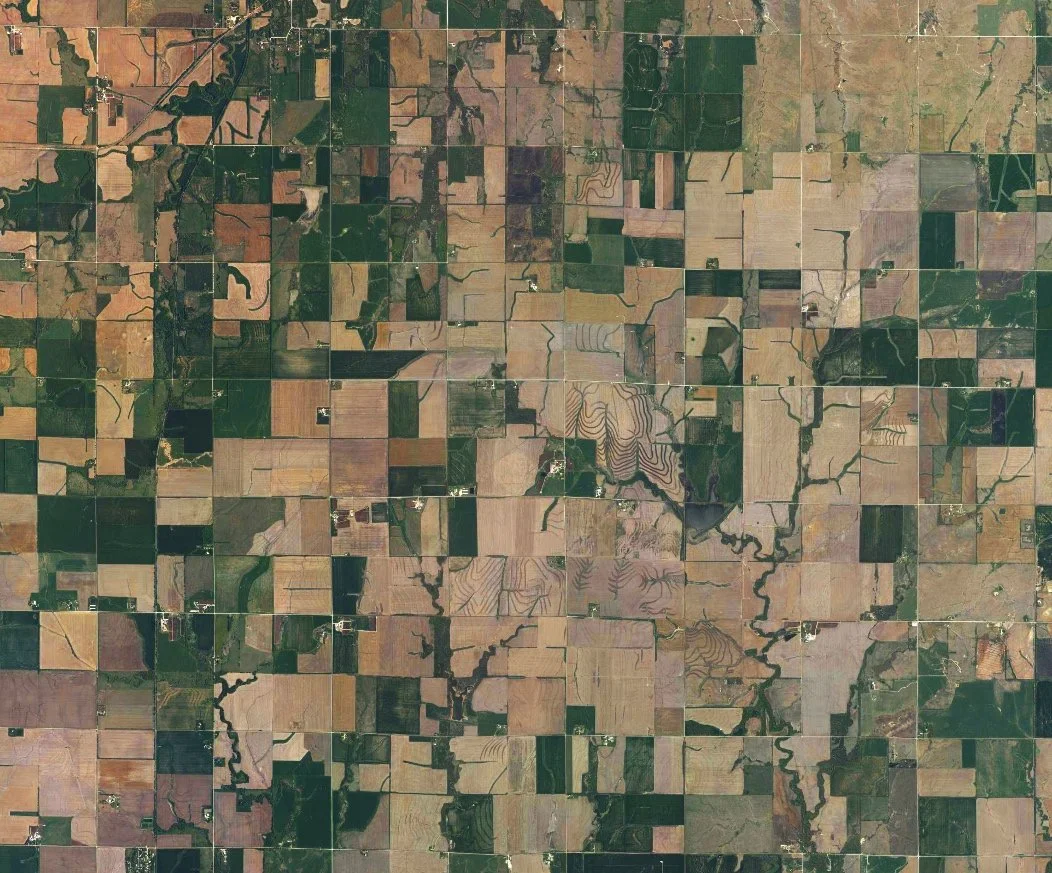

Uncertainty exists as to what generated the recent trade battles between the United States and China, with both countries imposing tariffs and bans on import and export of commodities. President Trump has imposed new tariffs in recent weeks, while China has responded in kind. Though the slight to the respective leaders may be real or imagined by each other, the consequences here in the United States have been very tangible. The price of soybeans has dropped consistently over the last two and a half months falling nearly 15%, to under $8.50/bushel. Photo from Nasdaq.com

These prices could continue to fall as China imposes new import tariffs on U.S. produced soybeans, pushing back against recent United States tariffs. China is currently the largest international importer of soybeans and other agricultural commodities in efforts to feed their growing population and confined animal feeding operations. With a growing swine breeding population and limited row crop resources, China will likely be looking toward South America to supplement imports that they are presently unable or unwilling to import from the United States.

However, the first and fourth quarters are perennially low supply times for South American crop exports and China may then be forced to purchase soybeans and other grains even with the added tariff taxes. Other potential avenues of recovery from plummeting prices for the US market include potential new buyers or increase in imports from other areas. The European Union imports the majority of their soybeans and other grain needs from Brazil and other South American nations. However, with an increased demand from China, South America may soon be short on overall supply, driving the European Union to purchase commodities from the other grain giant: the United States. While the current trade issues are creating real problems for American farmers and other commodity producers, there may be relief coming in the near future despite dire outlooks in international diplomacy.

Pork prices also took a tremendous hit, but are gradually returning to form. Pork fell as low as 51-52 cents per pound in mid-April before rebounding to over 80 cents per pound in early July. However, with new trade tariffs imposed by Mexico and China, the United States pork market could take a hit. Mexico has also lashed out against tariffs imposed by President Trump, placing tariffs on some U.S. commodities including alcohol, meats, and steel.

Meanwhile, China may place higher tariffs on U.S. pork if the trade issues escalate. China could increase tariffs on pork because they have their own steady supply and may be able to replace some of the lost U.S. imports with other international sources. This is troubling for the U.S. market because the rise in pork prices could be a front to a dramatic decline similar to that which has occurred with soybeans. The USDA remains optimistic, however, predicting a rise in pork exports for 2018 over 6%, and nearly 3% for 2019. The USDA report cited by Bloomberg in mid-June accounted for other growing markets and only a slight decrease in exports to Mexico despite their tariffs. The main issue remains the uncertainty that surrounds commodity trading and our administration’s actions and reactions to international trade policy, so remember to stay up to date on the market and global impacts that new trade issues may bring. As global unrest escalates, and new trade tariffs are unveiled weekly, we will all hold our breath and continue to watch for new developments.

By Nick Whitten, Summer Law Clerk

Sources consulted: