Row Crops Changing to Meet Consumer Demands

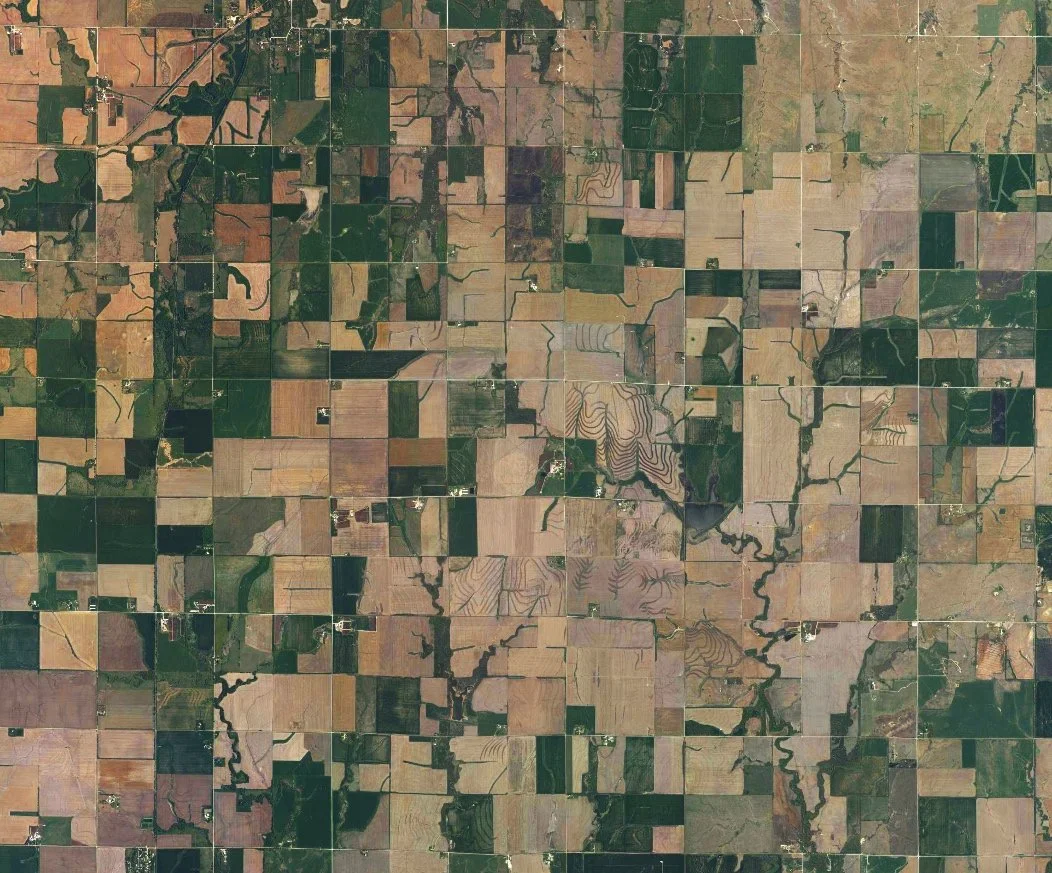

/Tyson Foods recently announced plans to improve environmental practices on two million acres of corn by the end of 2020. This announcement supports Tyson’s pledge to reduce greenhouse gas emissions 30% by 2030. Tyson will do this by “encouraging” farmers to adopt various conservation practices. Tyson has contracts with farmers who supply corn for Tyson’s livestock feed. Tyson will encourage those farmers to adopt practices which reduce fertilizer needs, water use, and soil runoff. To meet this goal, Tyson said it would work with other groups, including The Nature Conservancy.

It is not clear exactly what type of incentives Tyson will offer farmers. Will there be financial incentives for farmers who agree to implement recommended practices? Will Tyson refuse to contract with farmers who do not use specific practices? Many row croppers already implement conservation practices like cover crops, no-till, filter strips, and grassed waterways. Tyson buys corn from farmers to feed its poultry. Tyson also buys hogs and cattle from farmers who use grain to feed their animals. The two million acre target represents enough land to grow corn to feed all of Tyson’s annual broiler chicken production, as well as a some of the pigs and cattle the company buys from independent farmers and ranchers for its pork and beef operations. I would not be surprised to see additional protein and grain companies make similar pledges.

As I’ve written before, we are seeing national (and international) consumer demands impact farmers on the local level. Livestock farmers see this when large companies adopt animal care standards which reflect consumer or special interest pressures. We’ve seen restaurants and grocery stores demand cage-free eggs, larger spaces for veal and broiler production, and a halt in the use of gestation stalls for sows. These changes aren’t always caused by changes in regulations. Instead, public pressure on companies leads those companies to require certain production methods from their farmers. This has increased transparency, and sometimes brings the farmer closer to the company who sells the product through direct contracts. It can also have the effect of raising costs for farmers. Now we are seeing this practice expand from livestock to grain production.